Navigating the Road to Resolution: A Comprehensive Guide to GEICO Auto Claims

Navigating the Road to Resolution: A Comprehensive Guide to GEICO Auto Claims

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Road to Resolution: A Comprehensive Guide to GEICO Auto Claims. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Road to Resolution: A Comprehensive Guide to GEICO Auto Claims

Accidents are an unfortunate reality of the road, and when they occur, navigating the complexities of insurance claims can feel overwhelming. GEICO, a leading auto insurance provider, offers a streamlined claims process, with a dedicated phone number serving as a vital point of contact for policyholders. This article delves into the significance of this number, providing a comprehensive understanding of its role in facilitating a smooth and efficient claims experience.

The Importance of the GEICO Auto Claims Phone Number

The GEICO auto claims phone number acts as a direct line to the company’s claims department, providing immediate access to expert assistance. This number is crucial for:

- Prompt Reporting: Timely reporting of an accident is essential for initiating the claims process. The phone number allows policyholders to immediately notify GEICO, initiating the necessary steps for investigation and resolution.

- Initial Guidance: Upon reporting an accident, policyholders receive initial guidance from trained claims representatives. These representatives provide information on the next steps, document requirements, and answer any immediate questions regarding the claims process.

- 24/7 Availability: GEICO’s claims phone number is accessible 24 hours a day, 7 days a week, ensuring that policyholders can reach out at any time, regardless of the accident’s occurrence. This accessibility is particularly beneficial in emergency situations or when immediate assistance is required.

- Claim Status Updates: Policyholders can use the phone number to check the status of their claims, receive updates on progress, and address any questions or concerns that may arise during the claims process.

- Personalized Support: GEICO’s claims representatives are trained to provide personalized support tailored to each policyholder’s specific situation. They offer guidance on documentation, provide clarity on coverage options, and assist in navigating the complexities of the claims process.

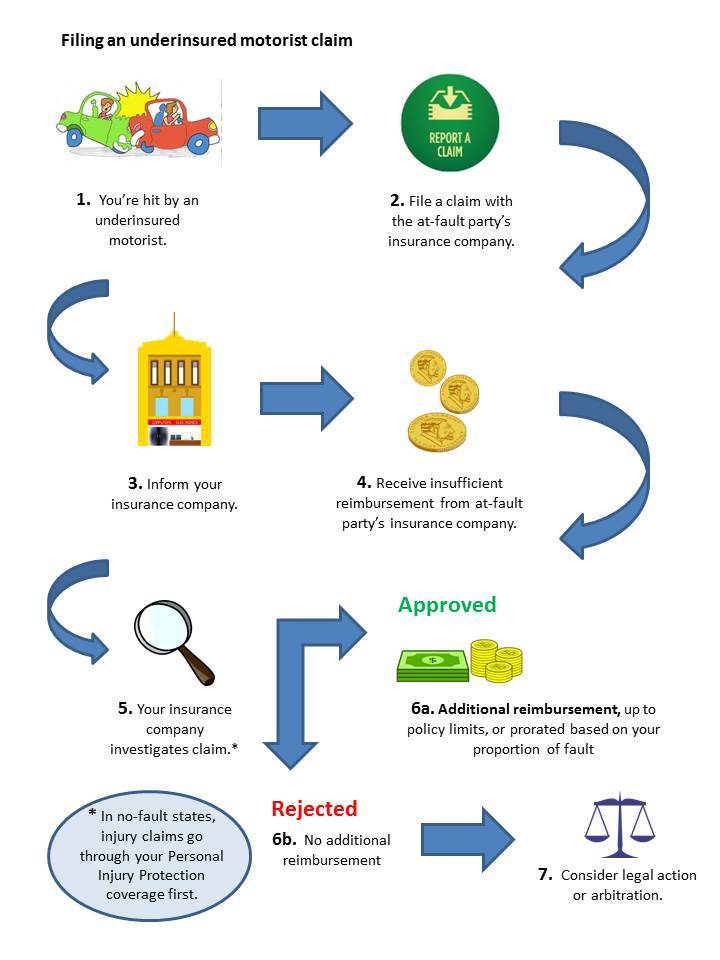

Understanding the Claims Process: A Step-by-Step Guide

The GEICO auto claims process, facilitated by the dedicated phone number, is designed for efficiency and clarity. Here’s a breakdown of the key steps:

- Initial Reporting: Upon an accident, policyholders immediately contact GEICO using the claims phone number. This notification triggers the claims process, ensuring prompt investigation and resolution.

- Gathering Information: Claims representatives will request essential information from the policyholder, including details about the accident, involved parties, and any witnesses.

- Documentation: Policyholders are guided on the necessary documentation to submit, including police reports, medical records, and vehicle repair estimates.

- Assessment and Investigation: GEICO’s claims department conducts a thorough investigation, gathering evidence and assessing the extent of the damage.

- Negotiation and Settlement: Based on the investigation findings, GEICO negotiates a fair settlement with the policyholder, covering expenses related to repairs, medical treatment, and other eligible costs.

FAQs Regarding the GEICO Auto Claims Phone Number

Q: What is the GEICO auto claims phone number?

A: The GEICO auto claims phone number is 1-800-432-4326.

Q: What if I need to file a claim outside of business hours?

A: The claims phone number is available 24/7, ensuring immediate assistance regardless of the time of day or day of the week.

Q: What information should I have ready when I call?

A: Have your policy number, details about the accident, and any relevant information about the involved parties readily available.

Q: Can I file a claim online?

A: While GEICO offers online claim filing options, the phone number remains a crucial point of contact for immediate assistance and personalized support.

Q: What if I’m not sure if my claim is covered?

A: Contacting GEICO through the claims phone number allows you to discuss your situation with a claims representative who can provide guidance on coverage and answer any questions you may have.

Tips for a Smooth Claims Experience

- Report the accident promptly: Timely reporting is crucial for initiating the claims process and ensures a faster resolution.

- Gather essential information: Collect details about the accident, involved parties, and any witnesses to provide accurate information to GEICO.

- Document everything: Preserve all documentation related to the accident, including police reports, medical records, and repair estimates.

- Communicate clearly: Maintain open communication with GEICO throughout the claims process, addressing any questions or concerns promptly.

- Understand your coverage: Review your policy to understand the extent of your coverage and ensure you are aware of any deductibles or limitations.

Conclusion

The GEICO auto claims phone number serves as a critical lifeline for policyholders navigating the complexities of auto claims. This dedicated phone line provides immediate access to expert assistance, personalized support, and a streamlined claims process. By understanding the role of this number and utilizing it effectively, policyholders can ensure a smooth and efficient claims experience, allowing them to focus on recovery and getting back on the road.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Road to Resolution: A Comprehensive Guide to GEICO Auto Claims. We hope you find this article informative and beneficial. See you in our next article!